In June 2016, some lysine producers continue raising their quotations.

According to CCM's price monitoring, as of 12 June, quotations from leading

producers were as follows:

CJ Group Co., Ltd.

-

98% Lysine: suspending offering quotations

-

70% Lysine: USD0.83/kg (RMB5.5/kg), up USD0.08/kg (RMB0.5/kg) MoM

Shandong Shouguang Juneng Golden Corn Co.,

Ltd.

-

98% Lysine: USD1.31/kg (RMB8.6/kg), up USD0.15/kg (RMB1/kg) MoM

-

70% Lysine: USD0.82/kg (RMB5.4/kg), up USD0.12/kg (RMB0.8/kg) MoM

Global Bio-chem Technology Group Co., Ltd.

-

98% Lysine: USD1.35/kg (RMB8.9/kg), up USD0.09/kg (RMB0.6/kg) MoM

-

70% Lysine: USD0.82/kg (RMB5.4/kg), up USD0.06/kg (RMB0.4/kg) MoM

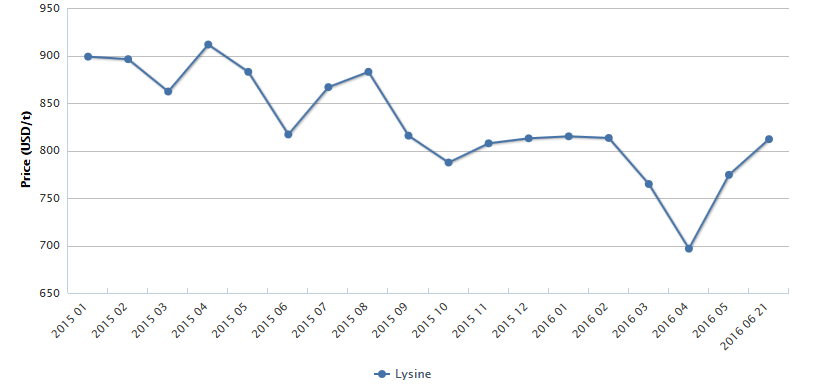

Manufacturers' promotion boosts domestic market price of lysine. According to

CCM's price monitoring, as of 21 June, the market price of 70% lysine reached

USD812.02/t (RMB5,350/t), up 4.86% MoM but slightly down 0.6% YoY.

Monthly market price of 70% lysine in China, Jan. 2015-June 2016 (as of 21

June)

Source: CCM

Lysine manufacturers continues raising their sales prices in June, due to:

1. Possibility of short supply

According to CCM's research, as of 21 June, some lysine producers' operating

rate remained low:

-

CJ (Shenyang) Biotechnology Co., Ltd.: has

not resumed production yet

-

COFCO Bio-chemical (Anhui) Co., Ltd.: is

still relocating its plant

-

Meihua Holdings Group Co., Ltd. and

Ningxia Eppen Biotech Co., Ltd.: are maintaining a temporarily low

operating rate and their supply continues being tight

At the same time, lysine manufacturers are slowly dealing with the orders

received previously. As a result, downstream producers who are in need of

lysine have to purchase the more expensive lysine to replenish their

inventory. So lysine manufacturers seize the opportunity to raise price.

2. Increasing raw material price

The rebounding market price of corn starch (raw material for lysine) is

favorable for the rise in lysine market price. At present, domestic corn market

is mainly led by the national temporarily stored corn which is sold at a

premium in recent auctions for overstored corn. Affected by this, domestic

market price of corn starch rebounds. According to CCM's price monitoring, as

of 21 June, the ex-works price of corn starch went up by 4.1% MoM to

USD356.96/t (RMB2,351.83/t).

3. Hyped soybean meal price

Domestic market price of soybean meal (substitute for lysine) continues rising

in June, driven by the news that yields of soybean may decrease in South

America. This boosts the demand for lysine. In this context, the manufacturers

are obviously more willing to raise the price.

Despite the recent rise in lysine market price, the slow recovery in demand for

feed may depress upward trend. Despite the slight increase recently, the number

of live pigs in farm is still lower than last year. According to the Ministry

of Agriculture of the People's Republic of China, the number of live pigs and

adult sows in farm decreased by 2.9% and 3.6% YoY.

On 18 May, 2016, the Ministry of Environmental Protection of the People's

Republic of China released a draft of the Technical Guidelines for Delimiting

Livestock Breeding Forbidden Area to solicit public opinion. Meanwhile, the

national elimination of small farms from the market continues. These factors

are unfavorable for the recovery in live pigs in farm. Therefore, the rise in

domestic market price of lysine is likely to be depressed in the coming period.

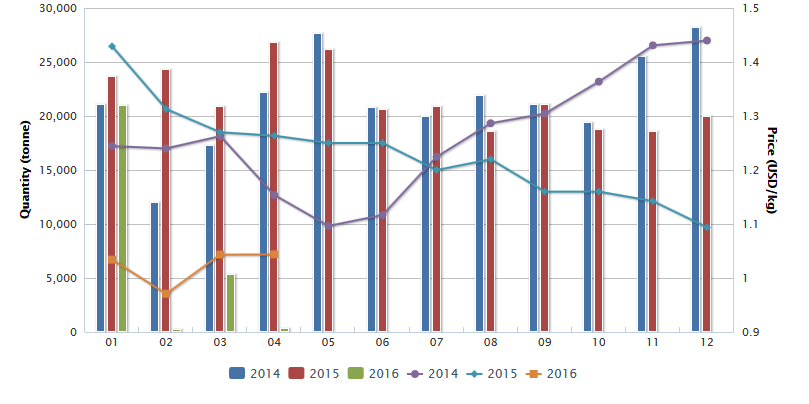

In April 2016, China's export of lysine fell slightly after the crazy surge in

March.

In March, the export volume of lysine hit record high in March. However, according

to China Customs, altogether 28,147 tonnes of lysine and lysine ester &

salt were exported from China, down 5.75% MoM but up 4.94% YoY.

Europe is still the leading export destination with increasing export volume.

In April, the export volume to Europe accounted for 49.58% of the national

total (33.82% in March 2016; 27.26% in full-year 2015).

Exports of lysine ester & salt in China, Jan. 2014-April 2016

Source: China Customs

This article comes from Corn Products China News 1608, CCM

About CCM:

CCM is the

leading market intelligence provider for China’s agriculture, chemicals, food

& ingredients and life science markets. Founded in 2001, CCM offers a

range of data and content solutions, from price and trade data to industry

newsletters and customized market research reports. Our clients include Monsanto,

DuPont, Shell, Bayer, and Syngenta. CCM is a brand of Kcomber Inc.

For more

information about CCM, please visit www.cnchemicals.com or get in touch with us

directly by emailing econtact@cnchemicals.com or calling

+86-20-37616606.

Tag: corn lysine